Sole Proprietorship egistration in 7 days

- Quickest registration in India: documents uploaded in 7 days or money back.

- Transparent process through follow-up and regular updates

Right plan for your business

Ledger Crafter's incorporation experts register over 1500 companies every month.

Starter/Lite

Ideal for initiating company registration-

What you'll get -

Expert assisted process

-

GST or MSME registration(Anyone)

Standard

Perfect for registration and tax filingsEMI option available.

-

What you'll get -

Expert assisted process

-

GST registration

-

MSME registration (Udyam)

-

GST filing for one financial year (upto 300 transactions)

-

ITR filing

-

Instant zero balance current A/c

Premium

Perfect for registration, tax filings and brand protectionEMI option available.

-

What you'll get -

Expert assisted process

-

GST registration

-

MSME registration (Udyam)

-

GST filing for one financial year (upto 300 transactions)

-

ITR filing

-

Trademark registration

-

Instant zero balance current A/c

Documents Required for LLP Registration

Identity and Address Proof

Scanned copy of PAN card or passport (foreign nationals & NRIs)

Scanned copy of voter ID/passport/driving

Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

Scanned passport-sized photograph specimen signature (blank document with signature [directors only)

Registered Office Proof

Scanned copy of the latest bank statement/telephone or mobile bill/electricity or gas bill

Scanned copy of notarised rental agreement in English

Scanned copy of no-objection certificate from the property owner

Scanned copy of sale deed/property deed in English (in case of owned property)

Limited Liability Partnership Registration Process

What we will do

What is a Sole Proprietorship?

Sole proprietorship in India is for one-owner businesses. They handle profits and taxes under their name or a trade name. It’s a common choice for small businesses and solo entrepreneurs.

A sole proprietorship company, owned and managed by one person, can be incorporated in fifteen days, making it a popular choice, especially among merchants and small traders. Registration isn’t mandatory as it’s identified through alternate registrations like GST. However, it has unlimited liability and lacks perpetual existence.

Documents Required For Registering A Sole Proprietorship

To start a Sole Proprietorship, the following documents are required

- Address and identity proof

- PAN card, KYC documents and

- Rental agreement or sale deed (in case of Shops & Establishment Act Registration).

What Are The Documents Required For Opening A Current Account?

To open a current account, the following documents are required;

- Proof of the existence of your business

- Shops & Establishments Act Registration

- PAN card

- Address and Identity proof

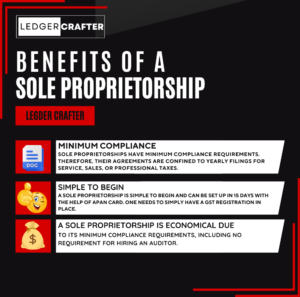

Benefits of Sole Proprietorship Firm

Easy to Set Up

Sole proprietorship firms are easy to set up and operate. There are no formalities to be followed for setting up a sole proprietorship firm, which makes it a popular choice among small business owners.

Full Control

The owner of a sole proprietorship firm has full control over the business. They are free to make decisions without any interference from others.

No Separate Legal Entity

A sole proprietorship firm does not have a separate legal entity from its owner. This means that the owner is personally liable for all the debts and obligations of the business.

Tax Benefits

Sole proprietorship firms are taxed as individual taxpayers, which means that the owner can claim deductions for business expenses and losses on their personal income tax return.

Minimal Compliance Requirements

Sole proprietorship firms have minimal compliance requirements compared to other forms of businesses. They are not required to maintain any formal records or hold annual meetings.

Flexibility

Sole proprietorship firms offer great flexibility to the owner in terms of operations, management, and decision making.

Low Cost

Sole proprietorship firms are cost-effective to operate as they do not have to pay for legal fees or comply with complex regulatory requirements.

Overall, a sole proprietorship firm is an ideal option for small businesses with minimal capital and limited liability.

Proprietorship Vs Limited Liability Partnership (LLP) Vs Company

The LLP Agreement will contain essential details such as the LLP’s name, the names and addresses of partners and designated partners, the business objectives, and the registered office address. Additionally, it will include other crucial clauses, such as the form of contribution and interest on contribution, profit sharing ratio, and the rights and duties of partners in various scenarios like admission, resignation, retirement, cessation, and expulsion. The agreement will also outline the proposed business activities and the rules governing the LLP

| Basis | Partnership | LLP |

|---|---|---|

| Governing Law | Partnership Act, 1932 | limited Liability Partnership Act, 2008 |

| Registration | The Registration of Partnership is not compulsory. However, the unregistered Partnership firm cannot be sued. | The Registration of LLP is compulsory with the Registrar of Companies (ROC). |

| Liability | Every Partner is liable, jointly for the acts of other partners alone or for all the acts of the firm in the course of partnership. | Under LLP, the liability of partners is limited as per their share of contribution |

| Legal entity | Partnership firms have no separate legal entity. | The LLP has a separate legal entity. |

| ITR | No returns are to be filed with the Registrar of Firms. | Under LLP, the liability of partners is limited as per their share of contribution |

| Enforcement | Partnership Act provisions are different in various states as the enforcement of the act is at the State level. | The annual statement of accounts and annual return has to be filed with ROC. |

| Can Minor become Partner | Minor can become a partner in Partnership. | In LLP, minors cannot become partners. |

| Features | Proprietorship | Partnership | LLP | Company |

|---|---|---|---|---|

| Definition | Unregistered type of business entity managed by one single person | A formal agreement between two or more parties to manage and operate a business | A Limited Liability Partnership is a hybrid combination having features similar to a partnership firm and liabilities similar to a company. | Registered type of entity with limited liability to the owners and shareholders |

| Ownership | Sole Ownership | Min 2 Partners Max 50 Partners | Designated Partners | For One Person Company |

| Registration Time | 7-9 working days | 7-9 working days | 7-9 working days | 7-9 working days |

| Promoter Liability | Unlimited Liability | Unlimited Liability | Limited Liability | Limited Liability |

| Documentation | Partnership Deed | |||

| Governance | – | Under Partnership Act | LLP Act, 2008 | Under Companies Act,2013 |

| Transferability | Non Transferable | Transferable if registered under ROF | Transferable | Transferable |

| Compliance Requirements | Income tax filing if turnover is more than ₹.2.5 lakhs | ITR 5 |

FAQ's on Sole Proprietorship Registration

Any Indian citizen with a current account in the name of his/her business can start a sole proprietorship. Registration may or may not be required, depending on the type of business that is planned to be established. However, to open a current account, banks typically require a Shops & Establishments Registration.

A Sole Proprietorship business does not take more than 15 days to set up and start functioning. This simplicity makes it popular among small traders and merchants. It’s also much cheaper, of course. This is the other reason why it’s the most widely used business structure.

Most local businesses are run as sole proprietorships, from grocery stores to fast-food vendors, and even small traders and manufacturers. That is not to say that larger businesses cannot operate as sole proprietorships, they can! Jewellery shops are sole proprietors, but it is not recommended.

This depends on the business you’re in. It is compulsory for any business whose turnover in a financial year exceeds ₹20 lakhs (₹10 lakhs in the case of North Eastern states) to get a GST registration. For businesses that are involved in selling goods or services to customers out of a commercial establishment, it is mandatory to register under Shops and Establishments Act.

Yes, it is much cheaper to run an LLP than a private limited company. Mostly because compliances, such as an audit, apply to LLPs only after their turnover is sizable. Most LLPs spend about half as much as private limited companies, in their first year on registrations and compliance work.

The procedure involved is a little tedious, but it is possible. It is very common for sole proprietors to convert into partnerships or private limited companies at a later stage of their businesses.

Proprietorship can take different forms based on the nature of the business. The common types of proprietorships include:

1.Sole Proprietorship: Owned and managed by a single individual.

2.Hindu Undivided Family (HUF) Proprietorship: Owned and operated by the head of a Hindu Undivided Family.

3.Minor Proprietorship: Managed by a minor, with a guardian overseeing the business until the minor reaches the legal age.

The main difference between a proprietorship and a firm is that a proprietorship is a business owned and managed by a single individual, whereas a firm is typically a partnership business where two or more individuals join together to run the business. In a proprietorship, there is no formal partnership agreement, and the sole proprietor bears all legal and financial responsibilities.

Yes, there are certain compliances for a sole proprietorship, such as filing income tax returns, maintaining accounting records, and fulfilling any industry-specific regulatory requirements. However, the compliance burden is generally lower for sole proprietorships compared to larger entities.

There is no specific minimum requirement to start a sole proprietorship. You can begin a sole proprietorship with minimal capital, and the requirements often depend on the nature of your business.